New data reveals customers prefer contactless and Apple Pay to using cash

- Contactless is by far the most popular payment method in the UK

- Mobile payments like Apple Pay came in second ahead of cash, third

- Nearly 1 in 3 people admit to never carrying cash

- Only 1 in 10 people still prefer Chip & PIN

- People stick to cash for security and budgeting purposes, while contactless users prefer convenience

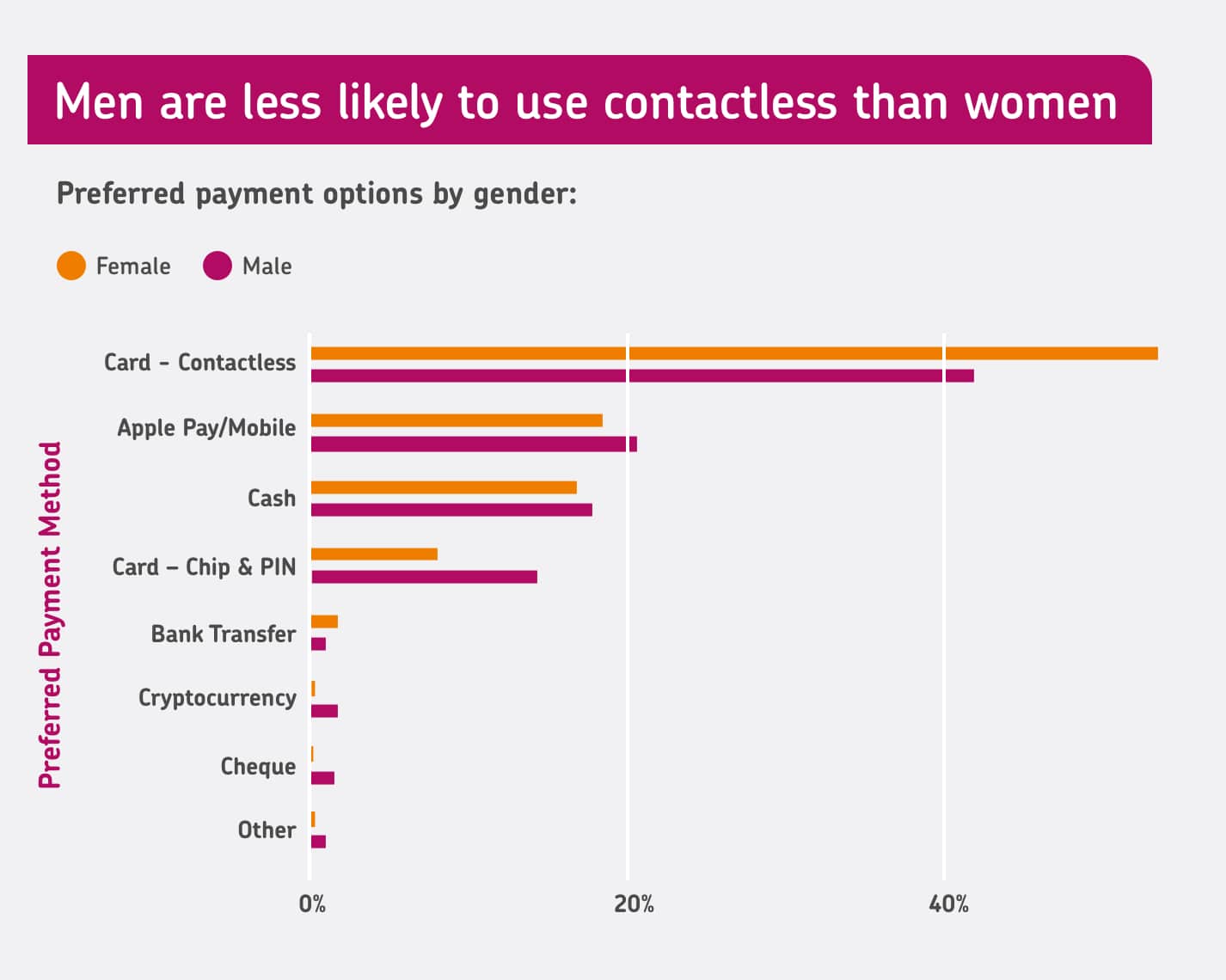

- Men are 22% less likely to choose contactless payments than women

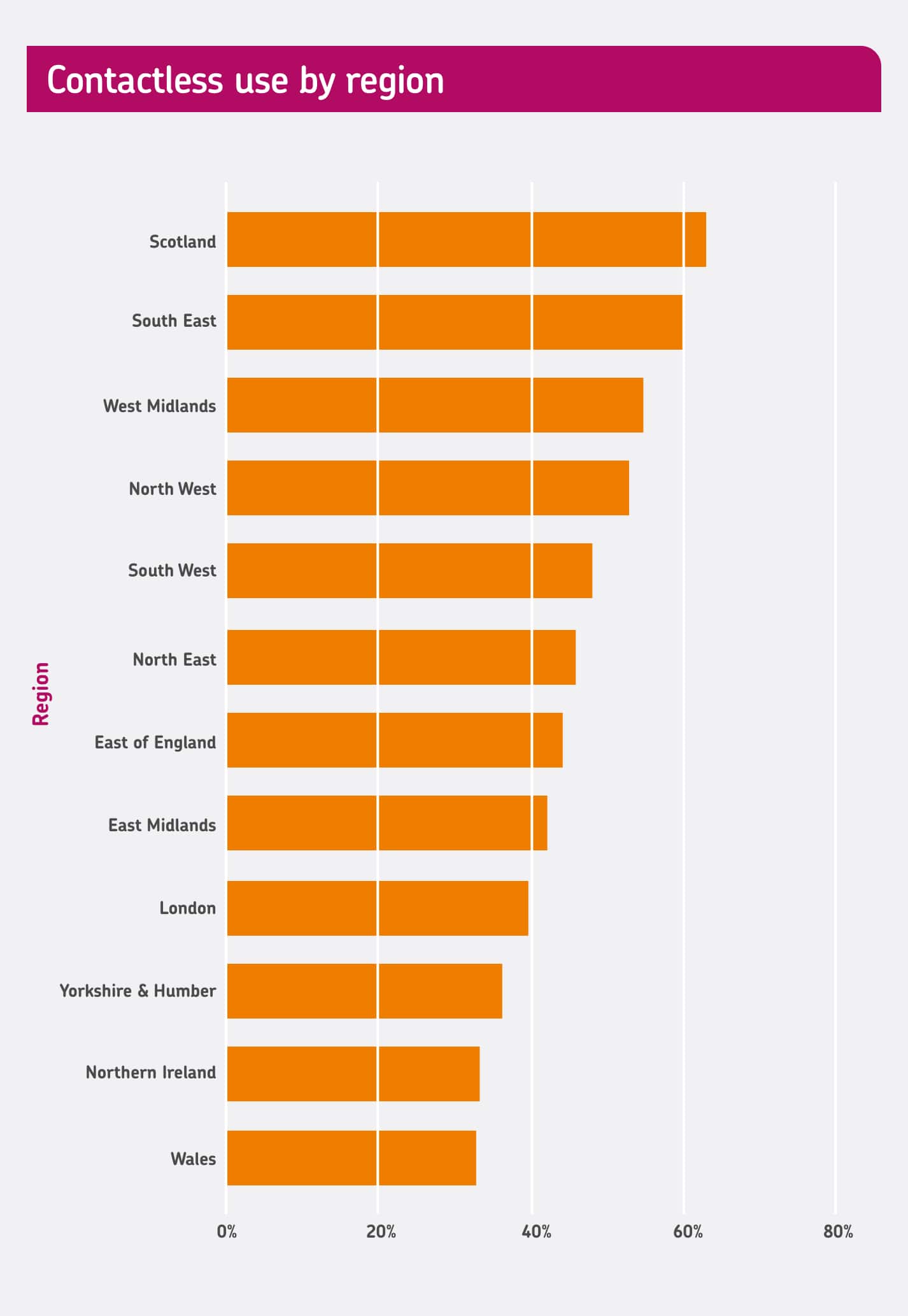

- Scots are the most likely to prefer contactless, while the Welsh are least likely

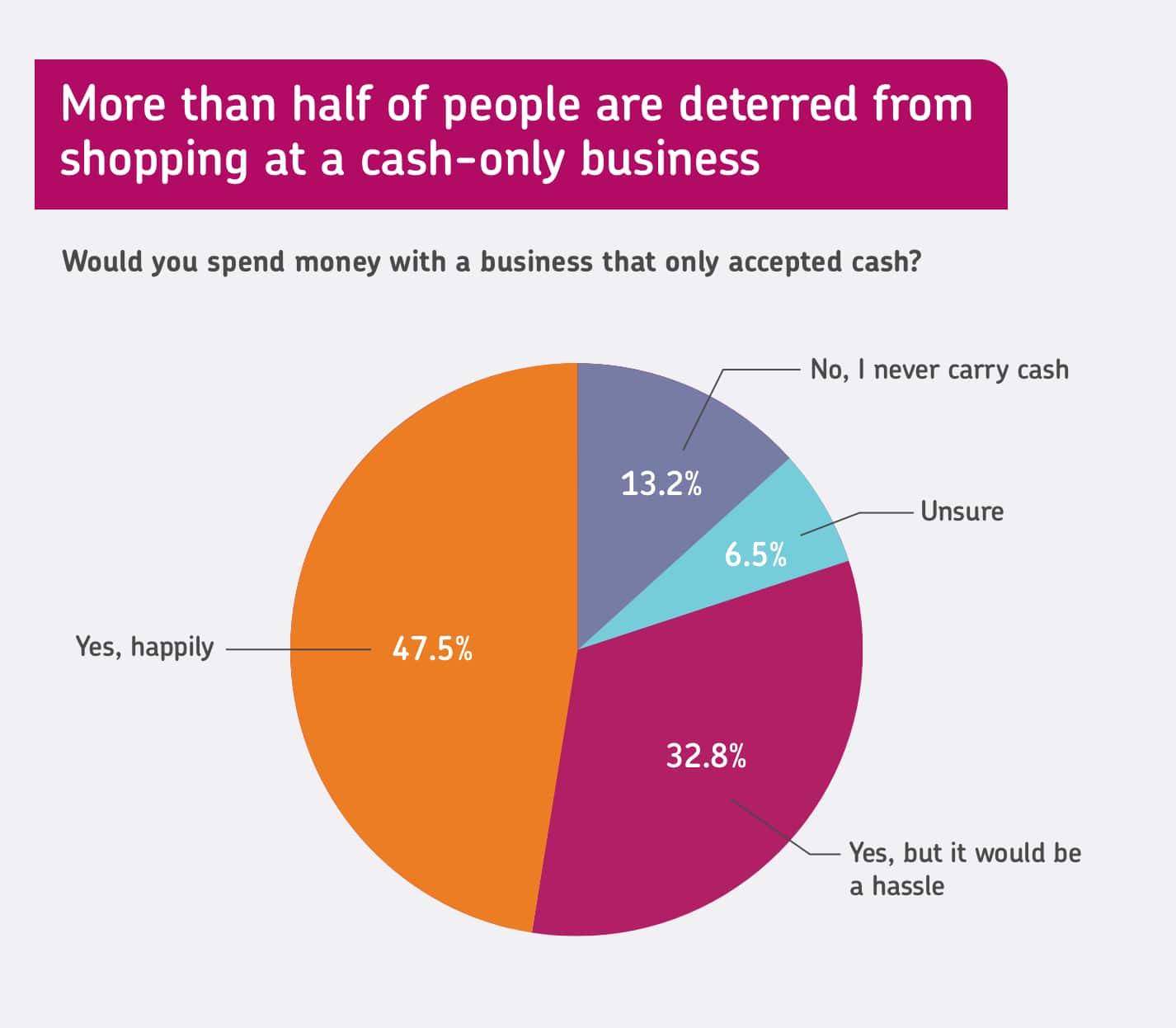

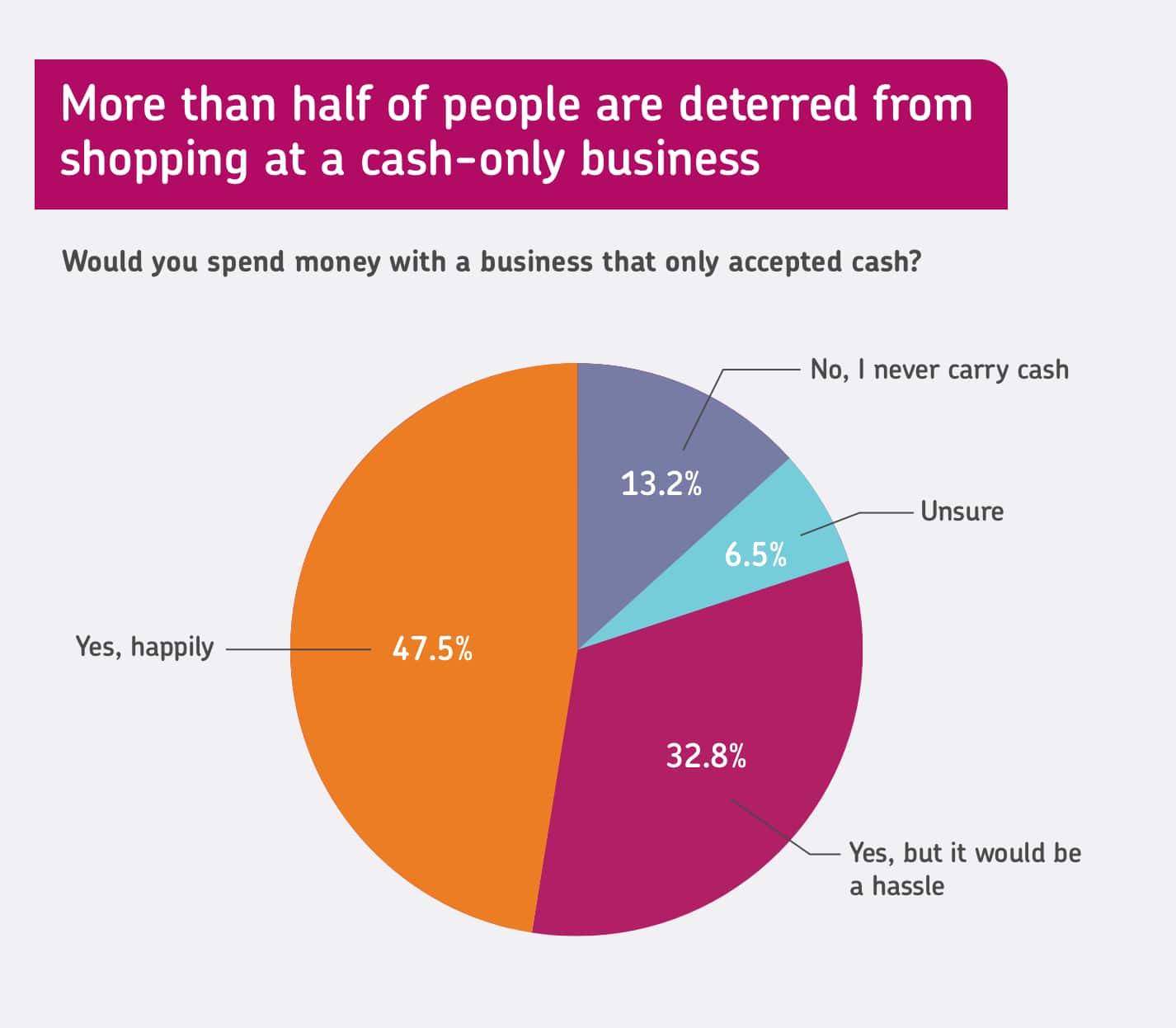

- More than half of people admitted to being deterred from shopping at a cash-only business

- There could be more than 275,000 UK businesses at risk of losing customers to cash-only policies

Cash is having a comeback — or at least that’s what the media would have us believe.

The rise of trends like “cash stuffing” on TikTok and news that soaring costs are triggering a reversion to carrying notes and coins has given rise to the narrative that households are ditching the plastic in favour of… well, the other plastic (the ones with the Queen’s face on).

But is that really the case?

To find out, we surveyed over 1,000 UK residents to ask them how they prefer to pay in shops and why. The results are an eye-opening reminder that cash is not the go-to option for most shoppers — and there’s plenty that small business owners can learn from it in 2023.

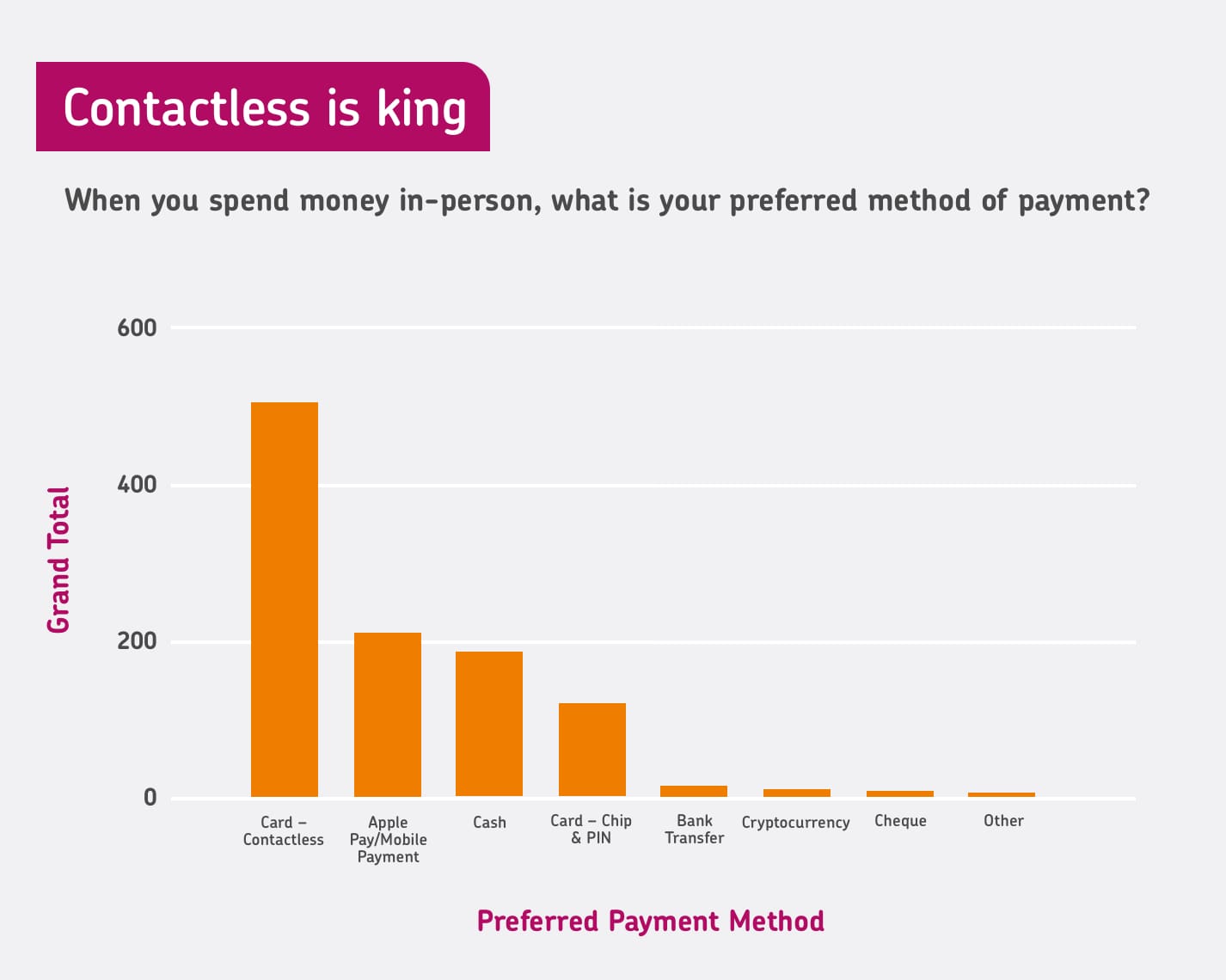

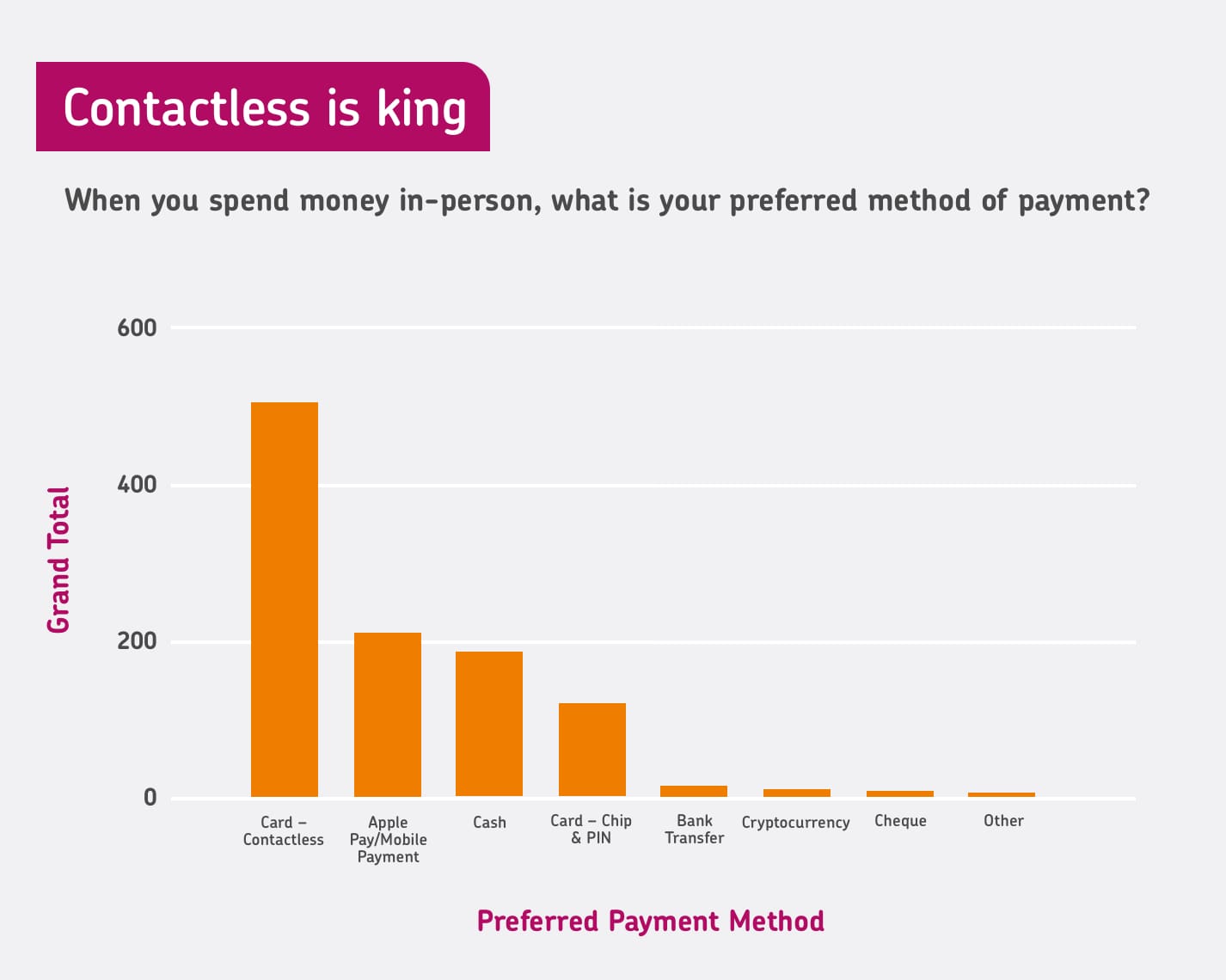

The data shows that contactless was by far the most popular payment method. Nearly half of our respondents (48%) said contactless card payments were their preferred choice, ahead of cash and Chip & PIN.

Perhaps surprisingly, mobile payments like Apple Pay and PayPal came out ahead of cash. 20% of respondents said they were their preferred payment method, compared with just 17% for cash.

Only 1 in 10 (11%) people still prefer to use Chip & PIN. takepayments's data shows that in the 12 months up to April 2023, Chip & PIN use declined by 12% while contactless jumped by a quarter (25%).

Does the UK lead the world for contactless payments?

Lloyds Bank released a report in September 2022 that found 87% of UK face-to-face payments were being made by contactless, accelerated by the COVID-19 pandemic (only 65% of payments in June 2019).

That’s quite a jump when compared with other leading economies. For example, estimates from Payments Journal suggest that only 45% of Americans use contactless payments, just half of the uptake of UK shoppers.

It’s possible that the UK’s trust in contactless was helped by its relatively early adoption. Contactless payments were introduced to the UK market in 2007, a whole eight years ahead of the US, which launched “tap to pay” in 2015. The increase of the UK contactless limit to £100 in October 2021 may have also played a significant role in its popularity over the past few years.

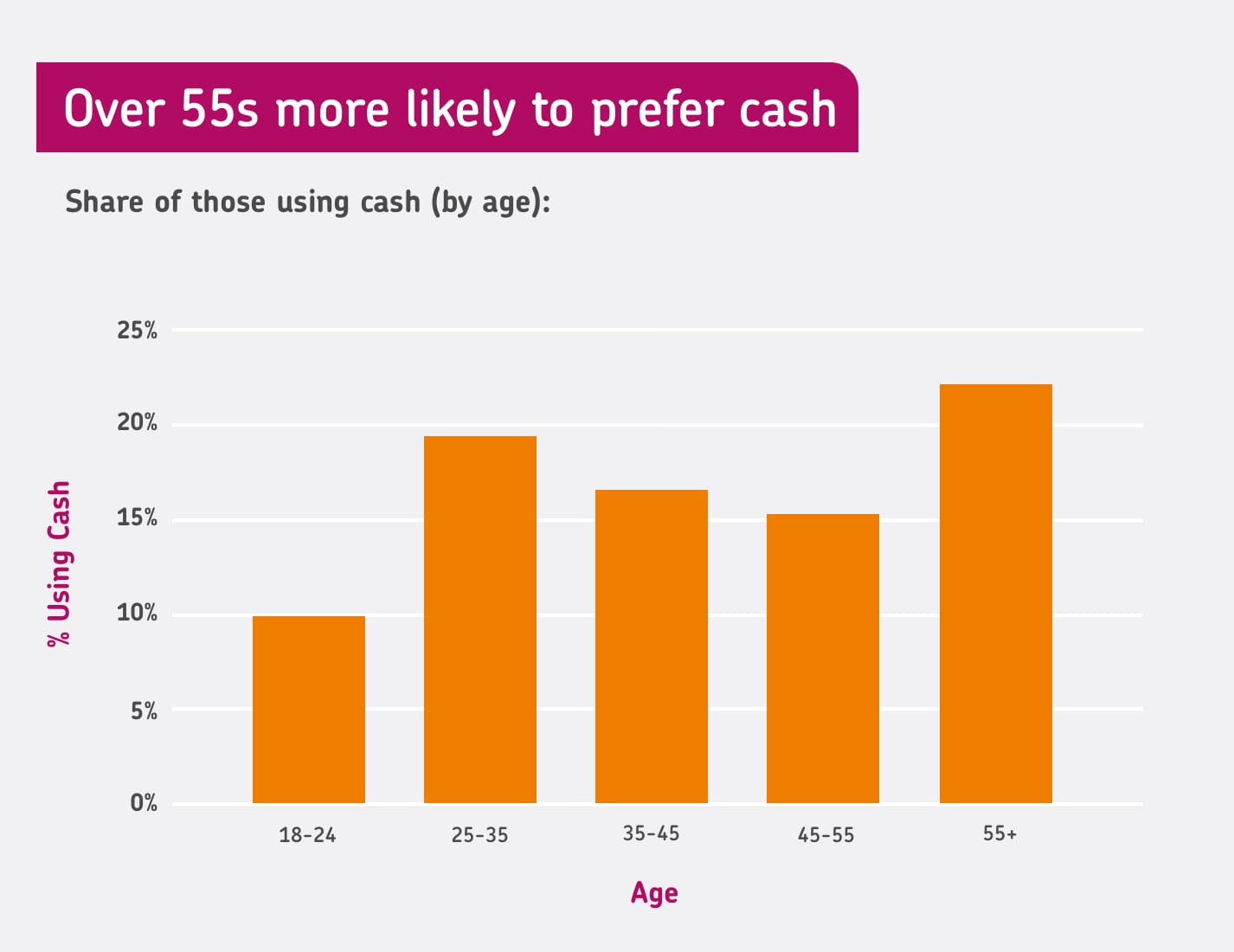

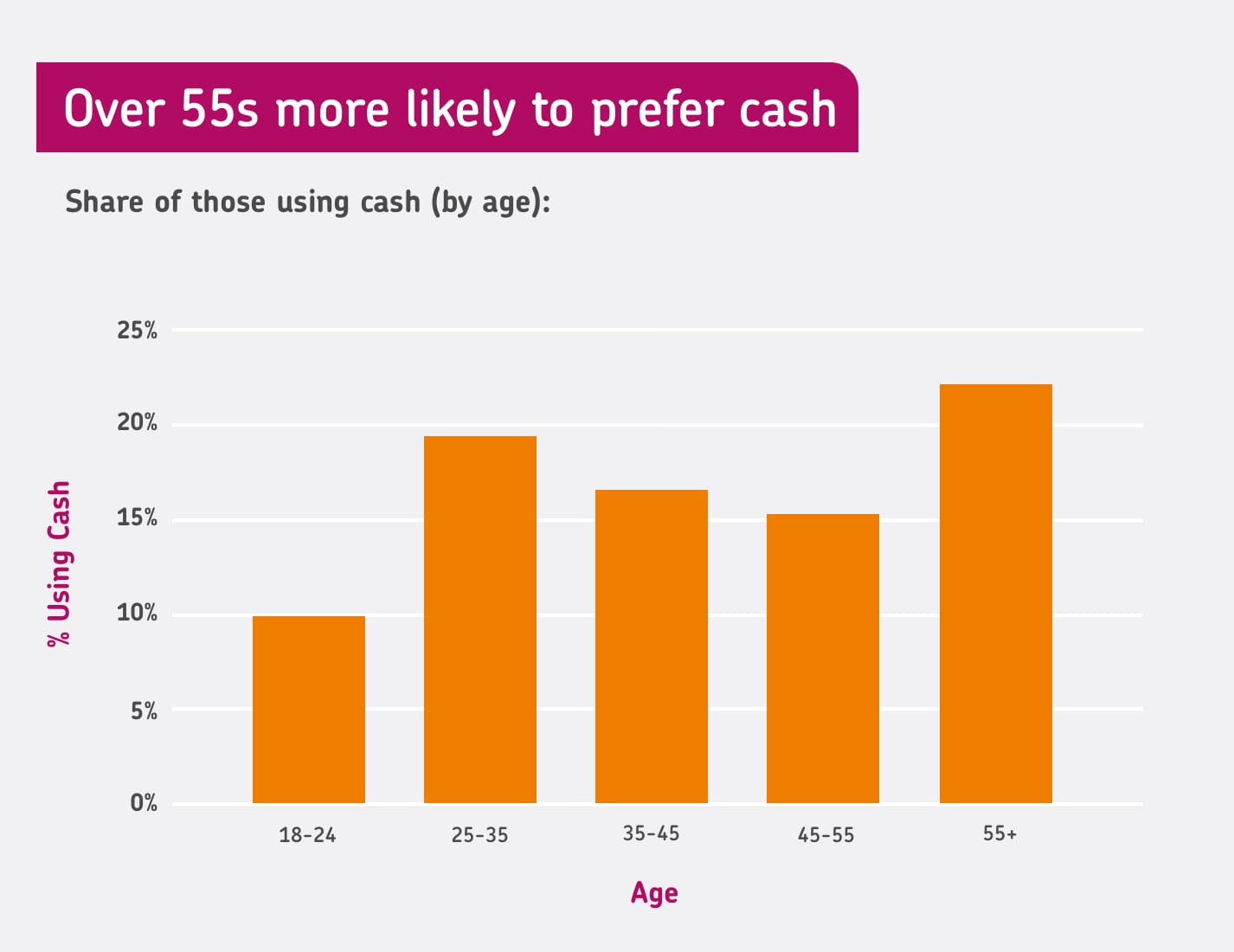

Our survey showed that the age group most likely to prefer cash is those aged 55 and over. Nearly a quarter (22%) of Over 55s said that cash was their preferred payment method, compared with just 1 in 10 (10%) 18-24s.

However, contactless was still the top payment method for every single age group. Nearly 3 in 5 (58%) Over 55s said they would use contactless before any other payment method. In fact, a study by Paragon published this year found that 4 in 5 (83%) over-55s are using cash less frequently than they were 5 years ago.

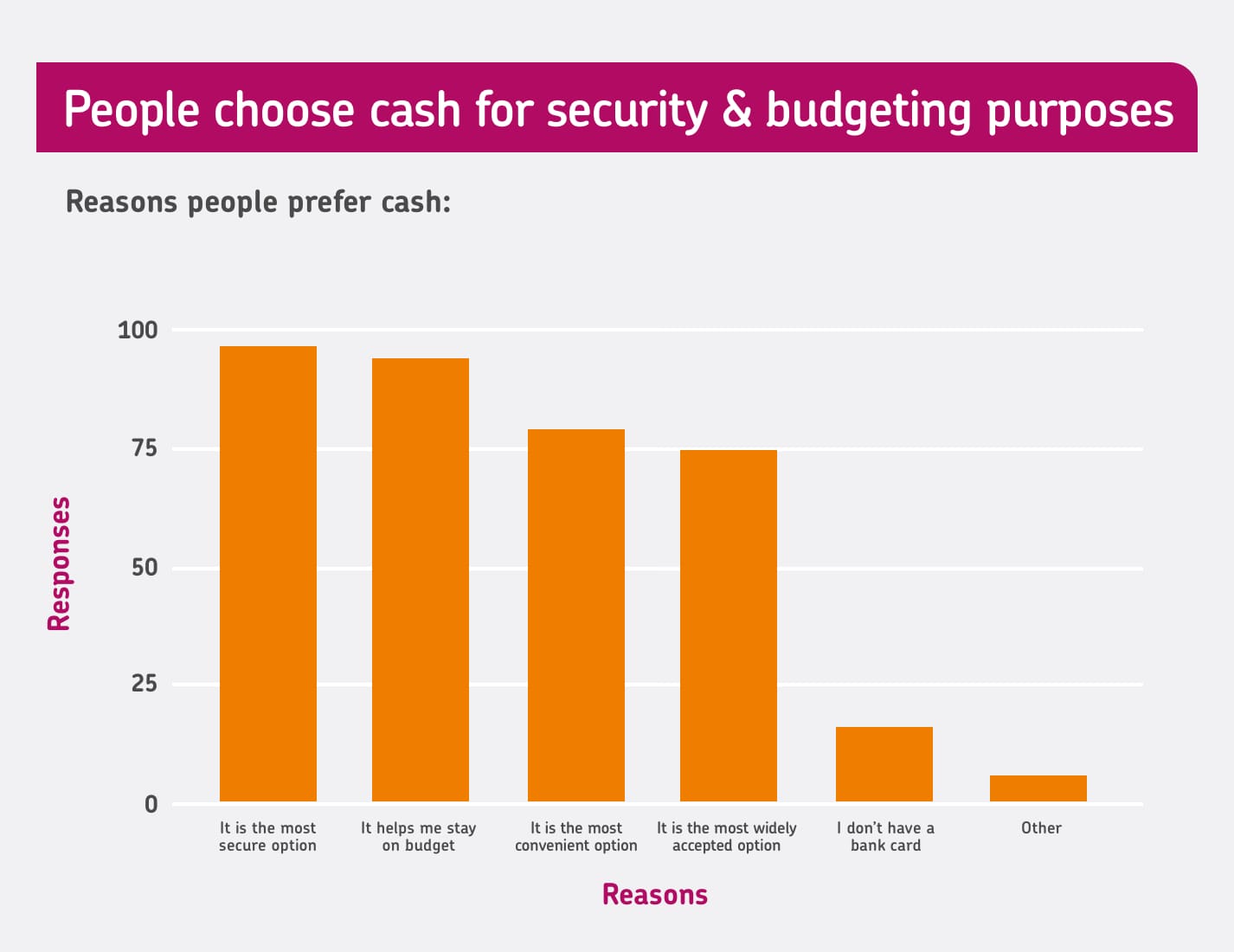

The top reason people prefer cash is they feel it’s the most secure option. More than half (53%) of cash users cited this as a reason they stick to coins and notes.

Budgeting came in as a close second. 52% of those who prefer cash said that carrying cash helps them stick to a hard spending limit, deterring them from overspending when in a shop.

Jodie Wilkinson, Head of Strategic Partnerships at takepayments, highlights why cash isn’t quite as useful for budgeting and security as many people might believe.

“Sticking with cash may sound good in theory, but:

- It requires physical money — Regularly withdrawing your income into cash may involve several trips to the bank. You’ll have to set time aside each week or month to get the money and budget your contributions.

- Money could be lost or stolen — Some people may find themselves carrying large sums of money around that could be lost or stolen. You’re unable to contact your bank and freeze payments like you are should you lose your debit or credit card.

- You may miss out on interest or cashback options — By dealing primarily in cash, you may miss out on cashback on card transactions and interest on savings.”

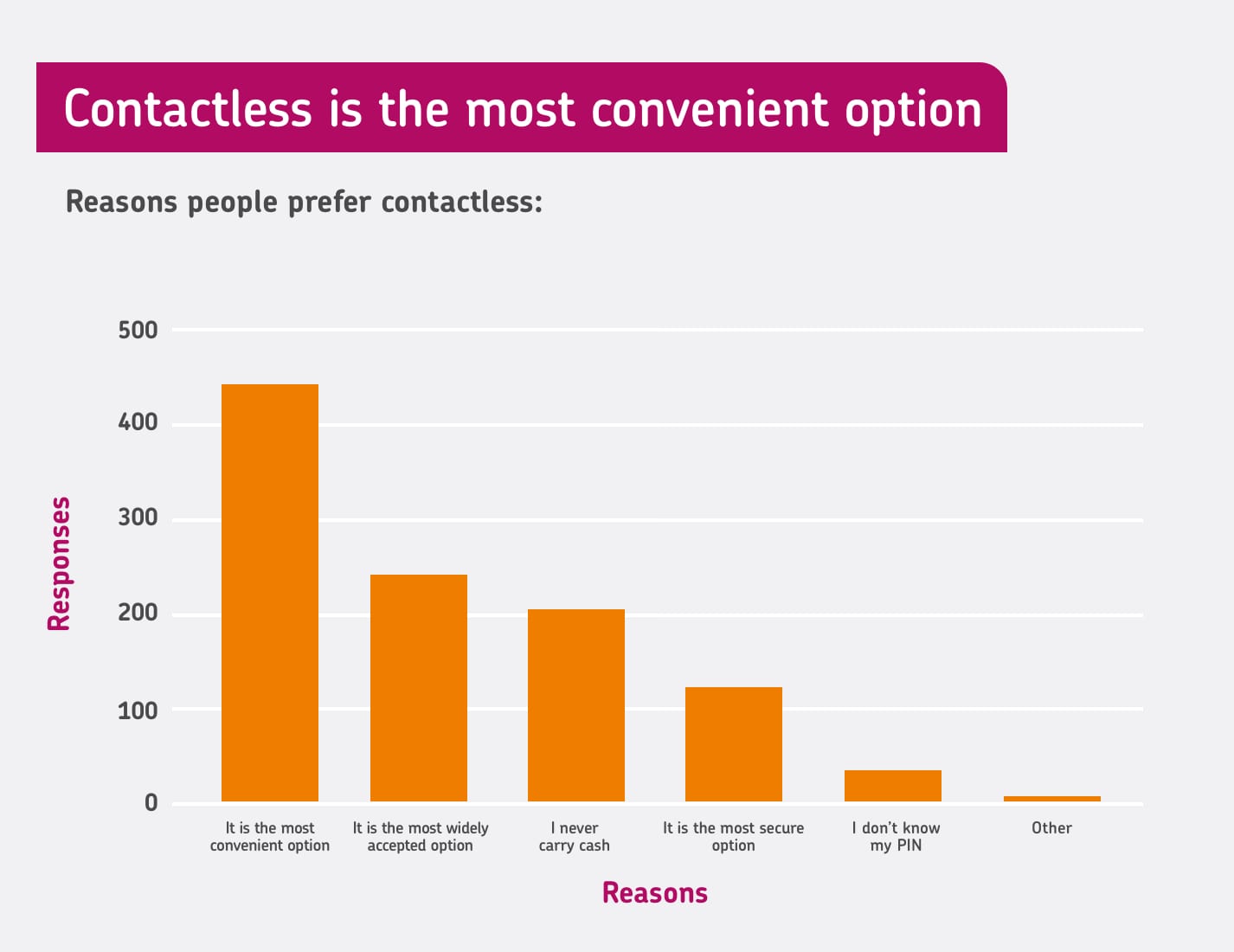

The biggest reason people use contactless is clear: because it’s convenient. Almost 9 in 10 (88%) of those who preferred contactless said convenience was one of the key reasons why.

Cash, on the other hand, may not be the convenient option it once was, as 2 in 5 (40%) respondents who preferred contactless said they never carried cash. In fact, nearly a third (31%) of all survey respondents said that they never carried cash, while 1 in 15 (7%) admitted that they didn’t even know their PIN.

Younger consumers are driving the adoption of mobile payments like Apple Pay, Google Pay, and PayPal. 3 in 10 (30%) 18- to 24-year-olds said that mobile payments were their favourite way to pay, compared with just 5% of Over 55s. Our own takepayments data also shows that contactless payments — including Apple Pay — grew by 596% in colleges and universities from 2021/22 to 2022/23. The FIS estimates that this continued growth of digital wallet payments will account for 21% of the UK market share by 2026.

Perhaps surprisingly, 25-34s were least likely to use contactless — they were almost twice as likely to use cash as their younger counterparts. However, they were the most likely to use Chip & PIN of any age group, and the second-most likely to use digital wallet payments like Apple Pay.

Men were less likely to prefer contactless than women (22% less likely) — more than half (53%) of women said contactless was their favourite payment method, whereas just 2 in 5 (41%) men said the same. On the other hand, men were significantly more likely than women to prefer Chip & PIN (14% of men vs 8% of women).

One Statista study found that 35% of men didn’t use contactless because they didn’t trust it, compared with 29% of women. Our survey data appears to support that finding, despite the popularity of contactless payments in 2023.

Scotland was the region that was most likely to prefer contactless payments, with almost 2 in 3 (63%) Scottish respondents. On the contrary, Wales was the least likely to pay by contactless: only a third (33%) selected it as their preferred payment method.

As it turns out, Scots have been proponents of tech-forward payment options for a while now. A study in 2019 also concluded that Scottish consumers are bigger users of contactless and mobile payments than the English.

Londoners were surprisingly low down the list for contactless payments. They were less likely than all English regions, except for Yorkshire & the Humber, to prefer to pay contactless. Research from Post Office and YouGov from 2021 found that the majority of Londoners (71%) believed cash to be an important consumer right, and more than half (55%) were concerned about local bank closures.

Businesses that still don’t accept some form of card payment could be at risk of putting off their customers.

Less than half (47%) of our respondents said they would happily shop with a cash-only business, while 1 in 7 people (13%) said that they wouldn’t because they never carry cash. 1 in 3 (33%) would still consider shopping with a cash-only business, but admit that they’d find it a hassle.

The friction users experience with a cash-only checkout process could be costing businesses millions of pounds a year. A study published by Finder revealed that small businesses that don’t accept card payments could be collectively losing 11.8 million customers annually. And in the UK, there could be as many as 275,000 businesses that could be losing out thanks to cash-only practices.

The key takeaways for small businesses

John Clark, Product Manager, said:

“The new data shows fairly clearly that the majority of customers want to pay with contactless methods — whether that’s physical or digital cards — wherever they shop. Failing to accommodate these needs could put small businesses at a disadvantage, as cash-free shoppers may take their money elsewhere.

For those businesses still unsure about adopting card payment solutions, there are several potential benefits to consider:

1. Faster payments — Today, card payments are three times faster than cash transactions. Going cashless reduces queueing time and allows for more efficient service, attracting customers and increasing sales.

2. More convenient — Cashless transactions eliminate the need for cash machines or bank visits. Mobile payment options look to cater to a broader customer base so your business could promote more ease and accessibility.

3. Enhanced safety – Cashless transactions may reduce the risk of robbery and employee theft. Card payments are less susceptible to fraud compared to cash due to improved security measures in card payments reducing the possible risk of counterfeit money.

4. Encourages higher spending – Consumers tend to spend up to 18% more when using cards than cash. Card payments offer flexibility and allow for friction-free spending; in fact, even just the presence of credit card logos seems to make people spend more.

5. Improved accounting – Digital transactions provide automated electronic records for easy accounting. EPOS systems integrate seamlessly with accounting software, reduce the likelihood of human errors, and facilitate accurate accounting.

6. Rewards and incentives – Cashless payments may attract customers who earn rewards or cashback. Credit card providers often offer incentives like points schemes and cash rebates, which in turn could promote spending at your business.”

Find out why thousands of businesses choose takepayments below.

Methodology

takepayments conducted a survey of 1,056 UK residents aged 18+ in June 2023. The survey contained three key questions:

- What is your preferred method of payment?

- Please explain why (users given the option to select up to 3 answers)

- Would you spend money with a business that only accepts cash?

The survey data was split into several key demographics: age range, gender, and location (based on UK regions, including Scotland, Wales, and Northern Ireland).

The study was conducted using two third-party survey platforms: Pollfish and Involve.

More insights from takepayments

Want more original statistics about UK businesses and consumer behaviours? Check out these other data reports and tools from our team: