Take secure card payments with Chip and PIN

Chip and PIN is just another name for a card machine, and we’re experts when it comes to helping you get set up with one.

Whether you want to take card payments from behind your till, around your shop floor or even on the move, we can help.

Take secure card payments with Chip and PIN

Chip and PIN is just another name for a card machine, and we’re experts when it comes to helping you get set up with one.

Whether you want to take card payments from behind your till, around your shop floor or even on the move, we can help.

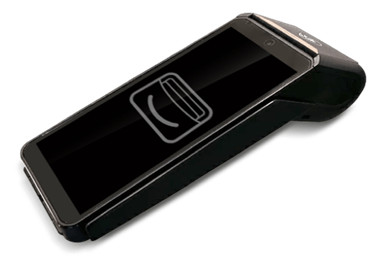

Choose your Chip and PIN terminal

Why takepayments?

.svg)

See what our customers are saying...

See how we're rated on Trustpilot

Take secure card payments with a chip and PIN machine

We know that every business is different, that’s why a local payment consultant will pop into your business for a quick chat, before helping you decide which chip and PIN machine is the most suitable for your business.

They'll also put together a super-simple pricing package designed around your business.

Whether you're new to card payments, or are looking at switching providers, speak to us to see how we can help.

Get a free quote

Why take chip and PIN payments

Taking card payments makes things easier for both you and your customers.

- It’ll speed things up and reduce your queues

- It can encourage your customers to spend more

- You’ll attract new customers you might have had to turn away in the past

- Less loose change means less opportunity for theft and fraud (and fewer trips to the bank too!)

Mark has been a gentleman the whole way through - so professional and nice. He explained everything and was honest about the upfront costs. That's really important to me.

Jake Johnson, Matrix Combat

FAQs

What is Chip and PIN?

Chip and PIN is a way to pay by card.

It was first introduced in the UK in 2006 to combat card fraud.

Before chip and PIN, a customer would have to swipe their card through a card machine and then sign to confirm a payment. So, if a card was ever lost or stolen, someone could just forge a signature to make a payment.

Chip and PIN changed that. Instead, customers are asked for a 4 digit PIN when it comes to paying with a credit or debit card.

Things have come on even further in recent years, with card machines now accepting contactless payments, up to £100, so chip and PIN is being used less and less for smaller transactions.

How does it work?

Chip and PIN is designed with security in mind. So, when your customer is ready to pay, they just pop the credit or debit card into the card machine. To verify the card transaction, they're asked to type in their 4-digit PIN.

The PIN is matched to the same code that’s on the card’s chip which helps to secure the transaction. So, once it’s verified, the transaction data will be sent to the business's merchant account for it to be checked and processed.

Which machine is right for my business?

Every business is unique, that’s why we’ve got a selection of machines to choose from.

If you own a shop or look after a reception area, a countertop card machine is ideal. It can be plugged in next to your till, so you can take payments from one place.

Run a hospitality business like a café or bar? No problem. With our portable card machine, you can take payments by taking the machine to your customers when they’re ready to pay.

If you’re a mobile business like a tradesperson or a courier, we also have a mobile chip and PIN machine that you can take with you. It doesn’t need to be plugged in to take payment; it’ll connect to the strongest mobile network in your area through a SIM card.

What cards will I be able to take?

You’ll be able to accept Visa, Mastercard, Maestro and American Express debit and credit card payments from your customers.

Plus, all our machines come with everything you’d expect, like contactless, Apple Pay and Android Pay with no extra cost to get this set-up.

Terms and conditions apply.

Businesses will be required to enter into and maintain a separate contract with an acquiring bank nominated by takepayments for the processing of the card transactions. Under the contract with the acquiring bank, transaction charges and other fees will apply.

*This service is available to takepayments Limited customers who are accepted for acquiring services and is subject to the acquirers' approval and terms & conditions. Your card machine’s banking window function must be performed before the acquirer's set time in order to receive settlement the next day or next banking day. Transactions processed via Ecommerce pay pages, pay by link and virtual terminals may be subject to different settlement timescales.

**Correct as of July 2024.