For small businesses, offering the right payment methods is what could turn window shoppers into paying customers, and that’s the aim of the game, right?

In fact, as many as 87% of consumers would reportedly abandon a purchase if they thought the checkout process wasn’t up to scratch, so nailing yours is an absolute must.

The payment landscape

The way UK consumers want to pay in 2020 has changed quite significantly, in no small part due to COVID-19 (although the tides had been turning for some time beforehand).

Card payments are the new payment method of choice for the majority of Brits, racing past old-timer cash, and claiming the crown as most frequently used.

In the wake of COVID-19 contactless payment popularity has also skyrocketed thanks to its touch-free nature reducing transmission fears, and the new £45 spending cap introduced back in April was rapidly adopted. Due to its popularity, the contactless limit was then upped again in October 2021 to £100.

As a small business owner, you no doubt want to keep your customers happy and take all the payments you can, right? Marketing experts argue to do just that you need to offer a multitude of options - at a very minimum more than one - to hit that sweet spot.

We want to see you succeed, so here we’ll break down all the methods on offer to take payments for small businesses, both face to face and online.

Face to face payment methods

As with all elements of running a business, the right payment method for you will depend on your business’ specific needs. That being said we’ll run through all your options and allude to which types of business they might be best suited to - just remember if you’re unsure or want a helping hand you can reach out to our friendly experts at any time.

Disclaimer: in this article, we’ll be describing our payment systems and their features and functionality. There’s no guarantee other suppliers’ equipment will be the same spec.

Card machines

We offer four top-spec card machines at takepayments: countertop, portable, mobile, and touchscreen, and all four are:

- Ready to accept all major credit and debit cards (i.e. Visa, Mastercard, Maestro, American Express, etc.)

- Set up for contactless and mobile payments (i.e. Apple and Android Pay)

- PCI compliant

- Simple to set up

- Print instant receipts

Countertop

Countertop card machines are exactly that - machines that sit on your point of sale (countertop, till point, bar, reception desk) and accept card payments.

Our machine is neat and compact so won’t clutter your workspace and is plugged into either your broadband or phone line by an ample cable.

Pros

- Smart and compact

- Easy to use

- Can be easily moved (particularly now to comply with distancing rules)

Countertop machines are ideal for any business that wants to offer card payments and has a fixed point of sale; such as shops and cafes.

Portable

Our portable card machine has all the functionality of the countertop reader but it can be moved around your business and allows you to take payments to the customer - don’t worry, it’s super lightweight.

It’s powered by Bluetooth and has an impressive 50-metre range. The machine boasts a long-lasting battery life but comes with a charging base that you can plug in out of sight and pop your reader on at the end of the day.

Pros

- No wires getting in the way or causing a trip hazard

- Take payments to your customers

- Lightweight and compact

Portable card machines are perfect for businesses like restaurants, bars, and pubs who take payments from customers around their premises.

Good to know: portable machines make complying with the government’s current table service only rules simple.

Mobile

Mobile card machines allow you to accept card payments anytime and from anywhere in the UK.

They’re powered by a sim card which uses 4G to connect to the strongest GPRS signal around, so with a mobile machine you’ll never have to turn down a job because you only accept cash.

Pros

- Hold a long-lasting charge

- Come with a charging unit you can leave at home, and

- A handy mobile charging cable (just in case)

- Light and durable

Mobile readers are suited to any business that wants to take payments on the road, including the likes of mobile window cleaners, beauticians, accountants, taxi drivers, etc.

Touchscreen

Our touchscreen card machine has a glass touchscreen surface which is a doddle to clean and using the terminal you can add up to six users and allocate tips by user too!

Pros

- Online reporting

- Plug and play

- Superslick design

- Wipe clean for hygienic payments

We’ve also created a mobile version which connects to 4G, WiFi, or Bluetooth, meaning you can take it on the road to the likes of exhibitions and festivals.

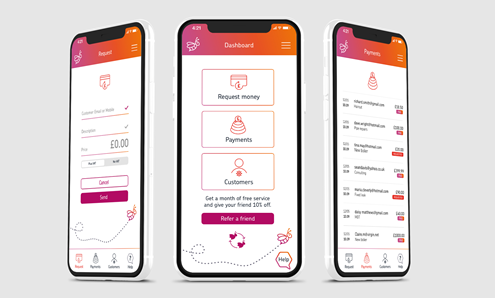

beepaid

We’ve been working hard on beepaid for some time now and although we might be biased we believe it’s the cream of the crop.

Beepaid is an invoicing app which makes getting paid a piece of cake - all you need is your mobile phone and you’re ready to go.

Simply open the app, enter your customer’s details, and send them an invoice. Once they’ve entered their card details you’ll get paid - we told you it was easy!

One of the major perks of beepaid is it allows totally contactless payments with zero spending cap - yep, you can allow your customers to pay contact-free no matter the transaction amount.

Pros

- Next day settlement

- No equipment necessary

- Fully contactless

- Inbuilt payment history and tracking functionality

Beepaid is suited to all manner of businesses from mobile services and tradespeople to takeaways and everything in between.

Digital payment methods

The prevalence of online payments is at an all-time high, and at takepayments we offer three top of the range options to suit a variety of businesses.

Payment gateway

With a payment gateway, your business is always open and ready to makes sales.

It hooks up with your shopping cart and allows consumers to pay for your goods and/or services through your website using their debit or credit card. Here’s how it works:

- Your customer browses your site and adds what they like to their basket

- They head to checkout (a page hosted by us) where they enter their card details

- You get paid.

Pros

- Compatible with over 50 UK shopping carts

- Can be customised to your business branding

- Real-time reporting

- We offer developer support

- Super secure

Pay by link

Pay by link makes getting paid online simple, but rather than going through your website it’s all done via email - in fact, you don’t need a website at all!

To use pay by link all you need to do is log in to our secure Merchant Management System and either:

- Create and send an electronic invoice

- Send a customisable email with a ‘pay now’ button, or

- Copy and paste a secure payment link into an email.

On the other end once your customer receives your email they’re taken to a super safe payments page where they enter their card details. Voila - you get paid.

Pros

- No need for a website

- Real-time reporting and payment tracking

- Accept international payments

- Customisable for a consistent customer experience

Pay by link is great for the likes of venues who take bookings or mail order businesses, but is a nifty option for any business who wants a better option than traditional paper invoices - waiting to get paid is tedious, right?

Phone payments

Thanks to virtual terminals accepting card payments over the phone couldn’t be easier - you simply log in to a secure page (hosted by us) on your end while the customer is on the line and enter their card details. That’s it.

You don’t need a bells and whistles website, simply an internet-enabled device like a smartphone, tablet, or laptop.

Pros

- Real-time reporting

- Straightforward to use

- Take payments from anywhere

- Connect with more customers

Phone payments are a great option for businesses operating in one location who want to widen their customer base. For example, a bespoke furniture business in Cornwall could accept a phone payment from a customer in Scotland thanks to a virtual terminal.

To wrap up

The takeaway from this article is you’ve got heaps of options when it comes to accepting payments for your small business. If you need a helping hand deciding which is the right method for you don’t hesitate to reach out.

We’ve got dedicated consultants up and down the country who’re ready and rearing to help - they’ll visit you and assess your specific business needs and together you can decide the right solution for you.

Remember, at takepayments we:

- Don’t charge sign up fees

- Tailor all our pricing to suit individual businesses, and

- Offer short 12-month contracts.